Bonita Unified School District

Bonita Unified Accounting Students Assist Community as Volunteer Tax Preparers

SAN DIMAS/LA VERNE – Local residents needing help filing their tax returns have received IRS-certified help from Bonita High School accounting students free of cost for more than 20 years, thanks to the Volunteer Income Tax Assistance (VITA) program.

Through the guidance of Bonita High accounting teacher Madhu Sekhri, who is a Certified Public Accountant, students immerse themselves in the fundamentals and complexities of tax law, with Sekhri training them in basic and advanced skills using software, testing guidelines and tests provided by the IRS under the VITA program.

“VITA gives students a real-world experience,” Sekhri said. “They are learning an important skill in filing tax returns, as well as gaining valuable experience as community service providers. VITA students work together, practicing leadership, organization, and cooperation.”

The Bonita High accounting career technical education pathway is a two-year program that includes beginning and advanced levels. Through an articulation agreement with Mt. San Antonio College, students can earn college credits for taking the first-year course, 2+2 Accounting. The second-year Advanced Accounting class is geared toward federal tax law and preparing VITA volunteers.

“Learning tax law is difficult, but the more you practice the better you get,” Bonita senior and VITA volunteer preparer Mariah May said. “The biggest challenges for me have been with taxpayers who are self-employed and need to file a Schedule C form.”

Tax preparation is held on site at BHS during one of Sekhri’s two daily classes or at lunch. Taxpayers bring essential information, such as a driver’s license, a Social Security card, W-2 forms, and a copy of the last year’s tax return. Students consult with taxpayers privately, then work on the forms in class while the taxpayer waits. The only restriction to participating in VITA is an income cap of $64,000.

Bonita High senior and VITA volunteer preparer Elizabeth Palala knew nothing about tax law before taking the class, and had trouble at first grasping tax filing terms and concepts such as journaling and inputting evidence of cash payments. Palala credits Sekhri for making a tricky subject easy to learn.

“Inputting data is easy, but understanding all of the concepts is complex, and you can’t make a mistake, so you have to make sure you are doing your due diligence,” Palala said. “At first I was nervous, especially with talking to taxpayers, but I have so much more confidence now. Ms. Sekhri has great knowledge and patience. I can’t imagine learning tax law from anyone else.”

VITA is a program that is generally offered at colleges, libraries and community centers. Bonita High is one of the only high schools in Los Angeles County that provides the service to its students and local residents, according to freetaxprepla.org.

“Bonita High School is proud to be a certified VITA provider, giving students and residents an affordable option for doing their taxes,” Bonita High Principal Kenny Ritchie said. “I can’t say enough about Madhu Sekhri, who has led the VITA program here for over 20 years, and has a great connection with her students. VITA wouldn’t be a success without the students, whose dedication to the program is exemplary.”

PHOTOS:

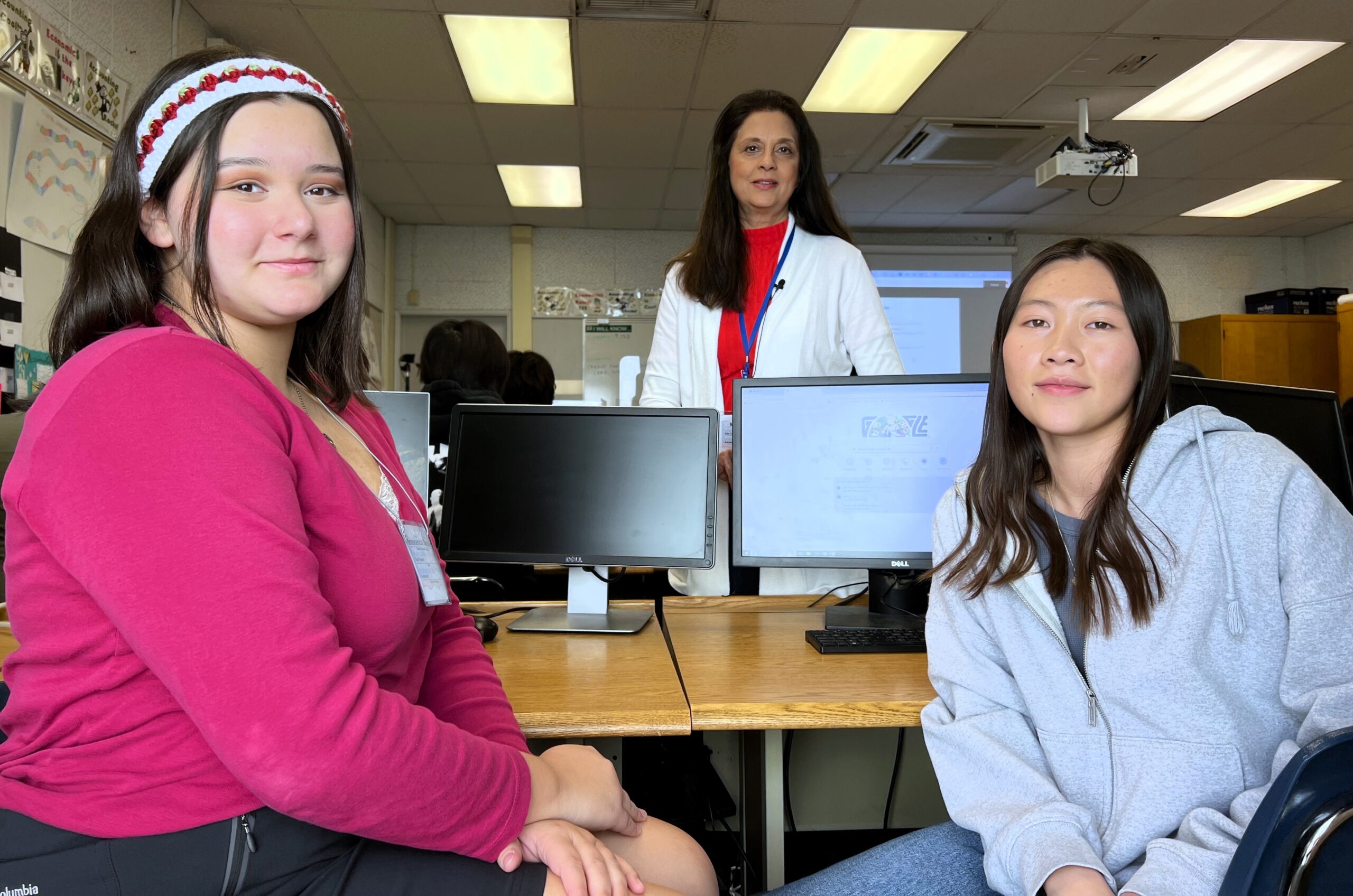

BUSD_VITA1: For more than 20 years, Bonita High School accounting students have provided tax preparation assistance free of cost through the IRS-certified Volunteer Income Tax Assistance (VITA) program. Through the guidance of accounting teacher Madhu Sekhri (center), Bonita accounting students immerse themselves in tax law before taking a test administered by the IRS that certifies them as VITA volunteers.

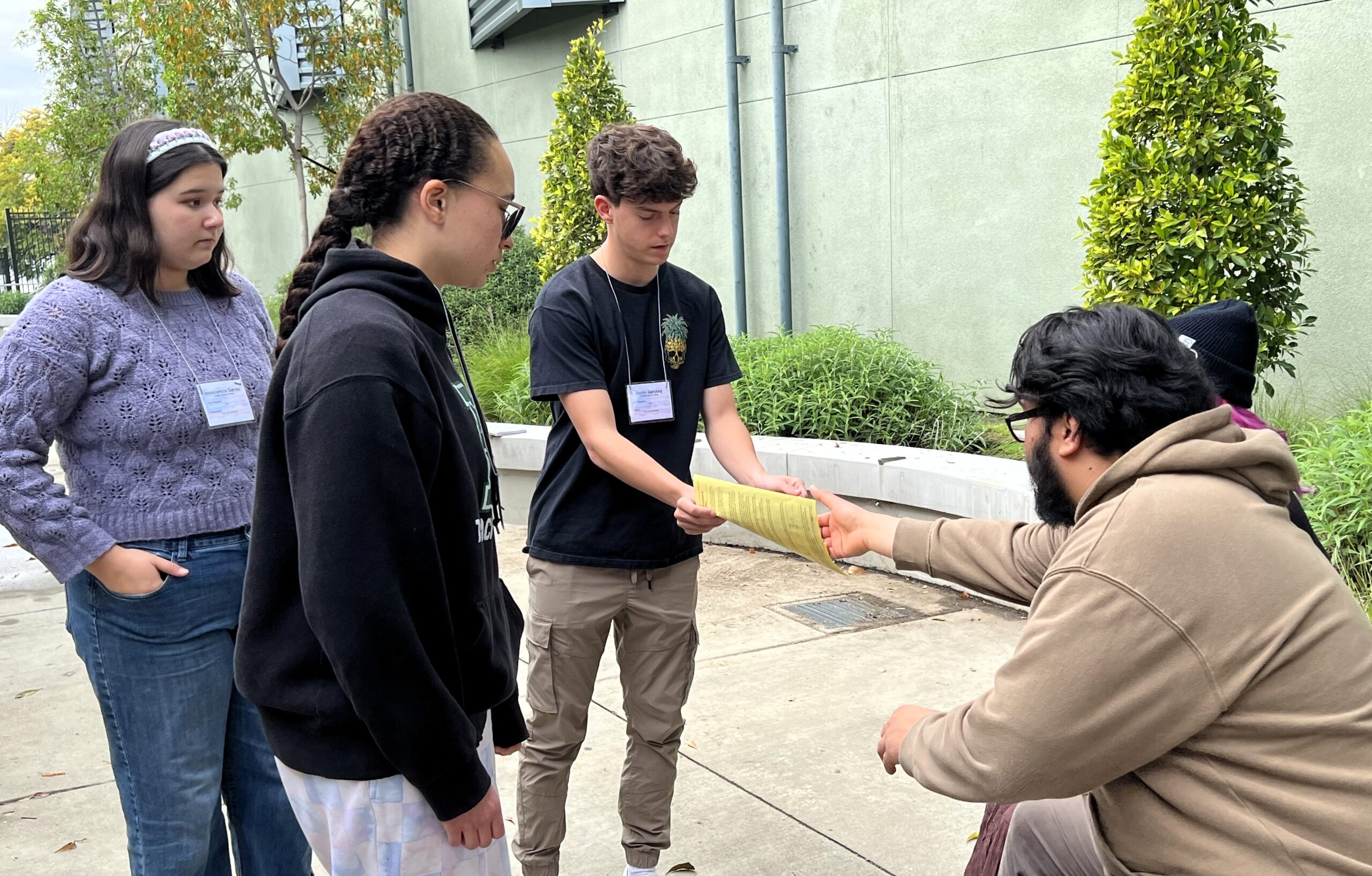

BUSD_VITA2: Bonita High School volunteer tax preparers consult with a family taking advantage of the school’s Volunteer Income Tax Assistance (VITA) program, which provides accounting students who have been IRS-certified to perform tax preparation for local residents, free of cost. The VITA program provides the students with real-world experiences as well as an opportunity to perform community service.

Bonita Unified Accounting Students Assist Community as Volunteer Tax Preparers

Bonita Unified School District

- Image Title

- BUSD_VITA1

- Image Caption

- BUSD_VITA1: For more than 20 years, Bonita High School accounting students have provided tax preparation assistance free of cost through the IRS-certified Volunteer Income Tax Assistance (VITA) program. Through the guidance of accounting teacher Madhu Sekhri (center), Bonita accounting students immerse themselves in tax law before taking a test administered by the IRS that certifies them as VITA volunteers.

Right-click on the image to save

- Image Title

- BUSD_VITA2

- Image Caption

- BUSD_VITA2: Bonita High School volunteer tax preparers consult with a family taking advantage of the school’s Volunteer Income Tax Assistance (VITA) program, which provides accounting students who have been IRS-certified to perform tax preparation for local residents, free of cost. The VITA program provides the students with real-world experiences as well as an opportunity to perform community service.

Right-click on the image to save